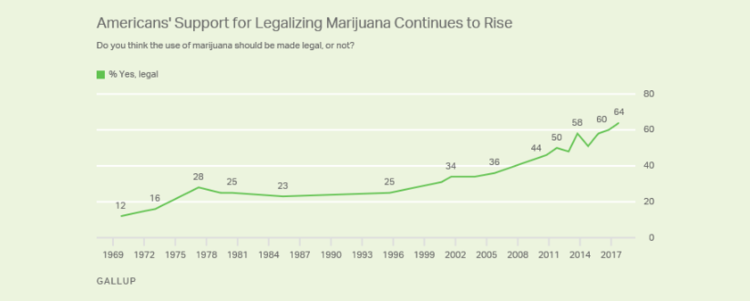

Michigan is about to join the list of states that have legalized the recreational use of marijuana. Although public support is high, 64% according to a 2017 Gallup poll, this bill does not come without questions or concerns, which mostly revolve around the issue of driving under the influence.[1] Just one more complex factor to further complicate the insurance industry, right?

Two 2017 studies reported that there was an approximate 6% increase in car accidents in states where the recreational use of marijuana is legal, and another 2017 study reported that recreational marijuana led to 3% more insurance claims.[2]

Based on this information, the assumption is that auto insurance premiums will increase due to the higher risk of car accidents. However, it is more complicated than that.

As psychology and statistics tell us, correlation does not imply causation. In other words, it is too early to tell whether these increases are due to the legalization of marijuana or whether they are just coincidences. After all, accidents still occur in states even where marijuana is still illegal—both recreationally and medically.

Furthermore, it is difficult to verify whether the accidents are in fact caused by recent marijuana intake. There are no tests similar to those used to test blood alcohol content levels, and even if these types of tests existed, then the issue is boiled down to accuracy:

Police have a particularly difficult challenge because of the way marijuana works in the body. Blood alcohol levels provide a direct correlation showing how much a motorist has had to drink, with those levels dropping rapidly as someone sobers up. But while THC [the active ingredient in marijuana] levels spike after smoking weed or eating a consumable, the psychoactive ingredient remains in the body for weeks, long after it has stopped having any impact.[3]

Much like texting while driving, where it is not the literal act of texting that causes accidents but rather the distraction that accompanies it, most insurance professionals expect the legalization of recreational marijuana (and anything else that has the potential to distract drivers) to ultimately lead to an increase in accidents and, consequently, insurance rates. However, only time will tell if the early statistics from other states hold true for those states and for Michigan.

This article was written by Tori Roughley. Please send comments or questions to Tori at victoria.roughley@boerinsurance.com.

NOTES

[1] RJ Reinhart, “In the News: Marijuana Legalization,” Gallup, January 4, 2018, https://news.gallup.com/poll/225017/news-marijuana-legalization.aspx.

[2] Jen Christensen, “States that legalized recreational weed see increase in car accidents, studies say,” CNN, October 18, 2018, https://www.cnn.com/2018/10/18/health/marijuana-driving-accidents-bn/index.html; John Egan, “Pot hole: How does marijuana use affect your auto insurance?,” Policygenius, August 1, 2017, https://www.policygenius.com/blog/pot-hole-marijuana-use-affect-auto-insurance/.

[3] Paul A. Eisenstein, “Legalized marijuana linked to a sharp rise in car crashes,” NBC, October 18, 2018, https://www.nbcnews.com/business/consumer/legalized-marijuana-linked-sharp-rise-car-crashes-n921511.