If you drive for a ridesharing company like Uber, you were asked to provide proof of insurance when signing up. Since auto insurance is legally required for all vehicle owners in Michigan, everyone should technically qualify to drive for a ridesharing company. However, the question is: do you have the right type of insurance?

It’s pretty simple: if you have a standard personal auto insurance policy, then you are not adequately covered to drive for a ridesharing company. As soon as the ridesharing app is turned on, your personal auto insurance policy turns off. However, most of the ridesharing companies provide some coverage for drivers if certain criteria are met.

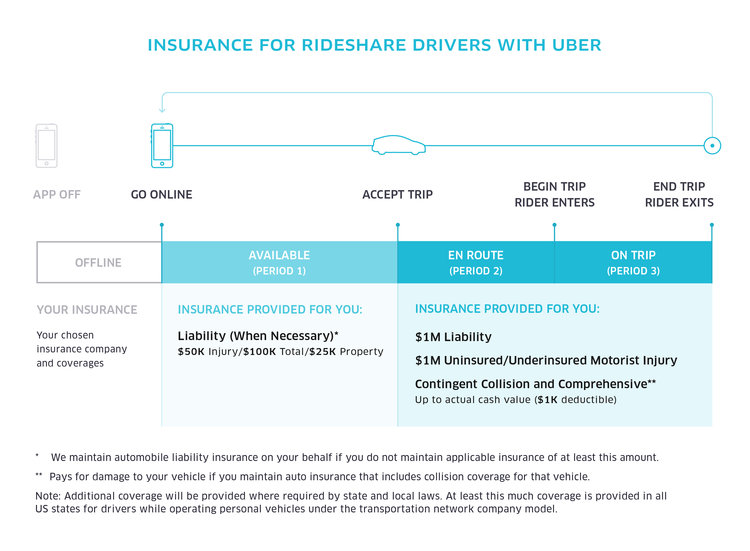

According to Uber, the company provides $1 million in liability coverage for bodily injury and property damage their drivers cause to others. They also provide collision and comprehensive coverage (with a $1,000 deductible) for damage to the driver’s vehicle, as long as 1) the driver has collision and comprehensive coverage on his or her personal auto insurance policy; 2) the ridesharing app is open and in use; and 3) the driver has accepted a ride request or is actively providing a ride.

However, if you are between trips, then Uber will only provide liability coverage slightly greater than Michigan’s minimum requirements, which is insufficient for most people. Furthermore, if you do not have physical damage coverage on your personal auto insurance policy or you have not yet accepted a ride request when an accident occurs, Uber will not cover any damage to your vehicle. The infographic inserted below is from Uber’s webpage discussing their insurance requirements and provisions:

Insurance companies are requiring drivers to disclose whether or not they use their personal vehicles to drive for a ridesharing company. As a full-time ridesharing driver, you should have a commercial auto insurance policy to protect you in the event you are sued for injuries you cause and for physical damage to your vehicle. If you drive only part-time for a ridesharing company, however, some insurance companies are beginning to offer ridesharing coverage via a special endorsement on a personal auto insurance policy that will expand your personal auto insurance coverage to be more appropriate for the risks associated with driving for a ridesharing company.

Through this endorsement, your personal auto insurance policy will provide liability coverage as long as the app is on and you have not yet accepted a ride. Once you accept a ride, you are relying on Uber’s provided coverage until the ride is complete. During this time, your personal auto insurance policy may provide excess physical damage coverage outside of Uber’s $1,000 deductible. In other words, if you have a lower deductible on your personal auto insurance policy than Uber’s, your insurance policy may pay the difference between your deductible and Uber’s deductible.

Even though these ridesharing companies advertise themselves as quick and easy ways to earn extra income, the cost of gas, vehicle maintenance, and auto insurance can quickly add up. Therefore, it is important to understand the costs and requirements, as well as what your insurance company will and will not cover, prior to applying.

If you need help understanding how your policy applies to ridesharing, or help determining which policy is appropriate, please don’t hesitate to ask.

This article was written by Tori Roughley. Please send questions or comments to victoria.roughley@boerinsurance.com.